Overview of Receivable Management

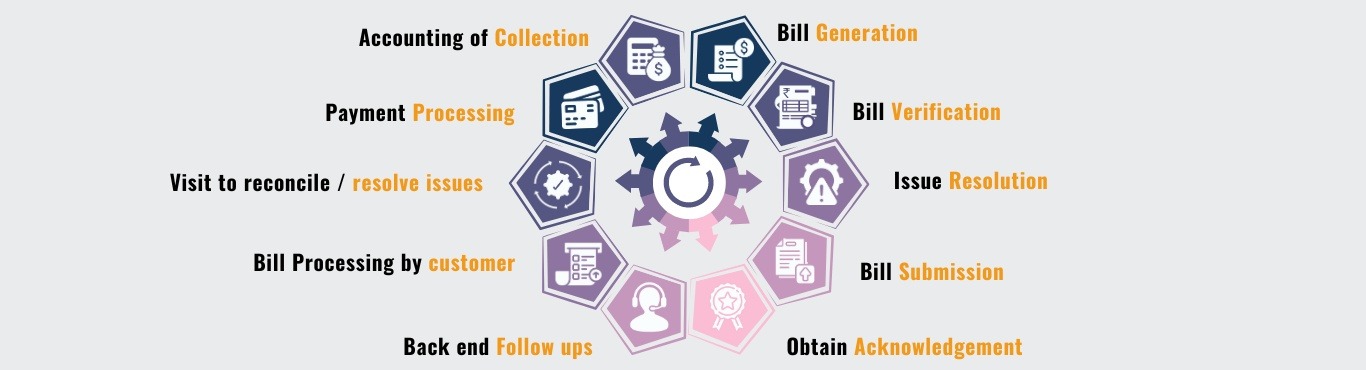

Receivable Management is a Pro-active & Preventive solution to own the complete process of Receivables after Invoicing till collection of money by systematically tracking & following up at each and every milestone to ensure timely Collection of Debt & Reduced DSO.

Receivable management helps in maintaining outstanding payments from customers, warding off overdue or non-payment scenarios, strengthening the company’s financial position, and allowing the business to run smoothly.

By definition, it might seem like an elementary task to perform but in verity, it is the most complex job to administer the receivables as per the nature of the business. It’s no hidden secret that, as the business grows, the process also becomes lengthy and complicated, which tends to be more error-prone. In such cases, the account holder and software ought to be adjusted to fit the business requirements.

Prime Benefits of Receivable Management are:

Receivable management enables business finance to run smoothly, giving a comprehensive overview of cash flow while keeping a record of every transaction. Furthermore, it facilitates business owners to keep track of their day-to-day transactions, preventing them from granting loans beyond their credit policies.

Have you ever wondered what would happen if the receivable was faulty?

Ultimately, the business will incur an immense financial loss because of bad debts. Monitoring proper accounts will enable the business owner or account holder to keep a close eye on the payment schedule and regular follow-ups with debtors, avoiding any late payments, resulting in optimal cash flow.

The receivables management helps in monitoring the buyers and their transactional performance, giving owners the ability to maintain a close relationship with purchasers by providing them with irresistible discounts and coupons holding uninterrupted payment records. Thus, developing a firm and ever-lasting relationship with buyers.

Increased revenues result from improved receivable management. When businesses offer credit facilities to their customers, they generate maximum sales volume, since more customers opt to purchase items on credit in order to take advantage of such benefits.

Most Common Receivable Challenges Companies Face

- Working capital gets blocked due to delay in collection of receivables

- High accumulation & write off of debtors as bad debts

- A high number of Receivable transactions under Reconciliation

- Funds to make up the Working capital deficit is bit expensive

- Dependency on Sales & Accounts/ Finance team for collections

- Problems in Collection from Customers at different Geography

- No dedicated Collection team / Dependency on Sales team for follow-up who end up concentrating less time on CORE SALES part.

- Difficult to Review & Monitoring of in-house team on collection progress.

- Customer Contact details are normally Scattered/Outdated with various executives.

- Issues with Customers are not immediately addressed or escalated which delays complete payment processing cycle.

- Non /delayed submission of invoice & supporting documents

- Lack of Consistent follow up and Reminder system which can Reduce DSO

What makes us stand out?

Each company faces the challenge of timely and correct collections from customers, and Pro-TEAM Solutions aids its clients with Receivables Management. With over a decade of experience in this field, we are known for our proficiency across India. Our experienced team is familiar with best account practices and uses in-house developed software to meet our clients’ needs and requirements.

We have outlined a few points that summarize our Account Receivable Management process and approach

- Managing the complete end to end receivables immediately after the invoice is being raised till it is collected

- Support over any chosen segment of the invoice life cycle

- Generating & Dispatching the Invoices

- Regular follow-ups to speed up collections

- Sending Reminders & timely escalations for necessary actions

- Dedicated Team to Follow-up and coordinate with Customers to ensure bills are accounted timely and resolve/attend any issues of customer.

- Proactive steps to ensure completion of pre-collection activities & coordinate in resolving the customer queries.

- Systematic collection procedures after payment delays

- Periodic Customer Balance Confirmations & corresponding Reconciliations

- Receivable Analysis & MIS for Decision making

Life Cycle of Receivables Management